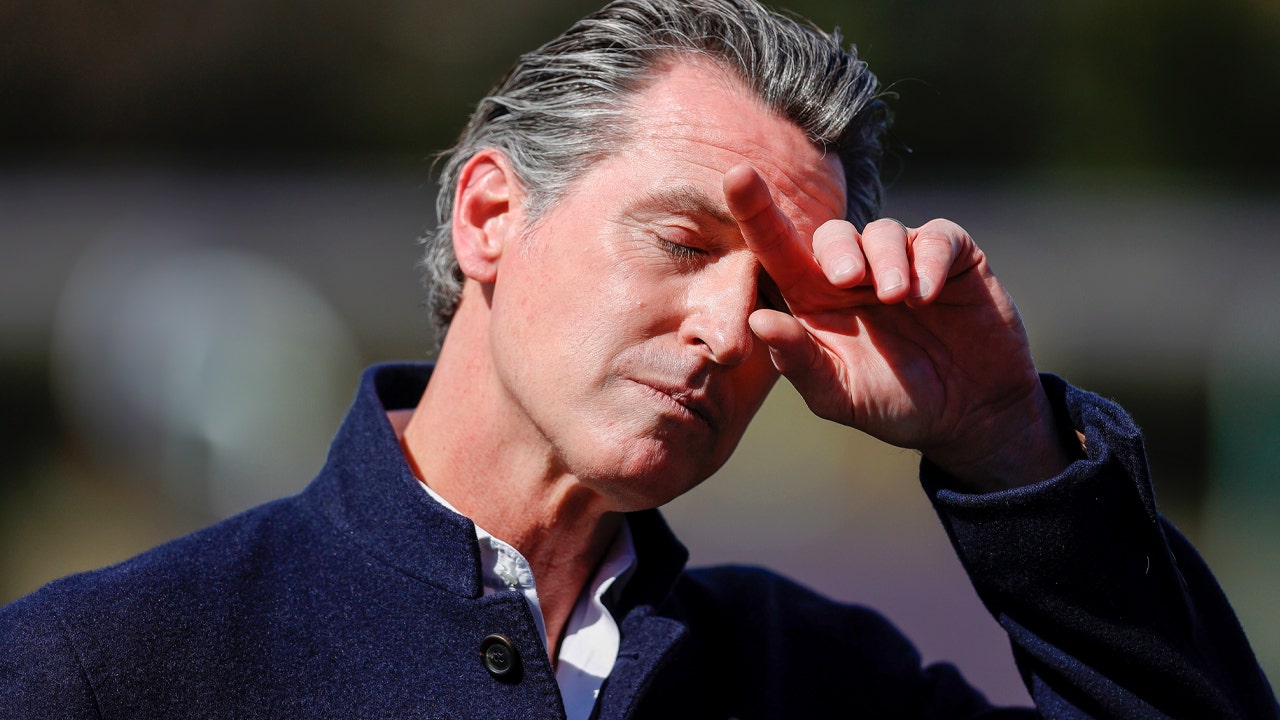

The unemployment benefits system in California is reportedly 'broken' with a $20B loan debt owed to the feds.

The state of California's unemployment-insurance deficit will be covered by taxpayers.

The UI financing system in California is facing significant deficits, prompting a complete "restructuring," as stated in a recent report from the nonpartisan LAO.

Despite being designed to be self-sufficient, the system has failed to cover annual benefit costs, leading to a projected $2 billion annual deficit over the next five years and an outstanding $20 billion federal loan balance.

The LAO report, titled "Fixing Unemployment Insurance" and published Tuesday, stated that the current outlook is unprecedented as the state has never before run persistent deficits during periods of economic growth, despite having failed to build robust reserves during these times in the past.

The UI Trust Fund, funded by employer payments, hasn't been updated since 1984 and cannot provide the intended wage replacement of half of workers' wages, according to a report by independent analysts. As a result, annual shortfalls are projected to increase California's federal loan, costing taxpayers around $1 billion in interest each year.

Analysts discovered that the current employer tax structure discourages eligible unemployed workers from claiming benefits, while the state's low taxable wage base hinders the hiring of lower-wage workers.

To address the funding gap for unemployment benefits, one suggestion is to increase the amount of wages taxed, from $7,000 to $46,800 per worker. This change is supported by those who believe it will generate more revenue for the program. Additionally, the report suggests simplifying the taxation system for businesses that contribute to unemployment benefits, in order to motivate more hiring.

The report proposes dividing the federal loan cost between employers and the state government to prevent businesses from being solely responsible for the debt.

"Analysts noted that the problems mentioned in the report are significant on their own, but even more so when combined. The proposed changes in the report are a reflection of these issues. Despite the Legislature's actions, employers will soon pay more in UI taxes due to rising charges under federal law."

The California Employment Development Department's spokesperson, Gareth Lacy, described the report as "thoughtful" and stated that officials are carefully reviewing it.

Lacy stated to Planet Chronicle Digital that the issue has been ongoing for decades and the pandemic has only intensified it.

The state's unemployment insurance system was overwhelmed during the COVID-19 pandemic, leading to a $20 billion borrowing from the federal government to cover benefits, which the state is still paying off.

"The state's tax system will not be able to repay the loan, and the balance will continue to increase due to the persistent difference between contributions and benefits, according to the report. This will result in a permanent feature of the state's UI program and a significant ongoing expense for taxpayers."

politics

You might also like

- California enclave announces it will cooperate with immigration officials and the Trump administration.

- Danish lawmaker urges Trump to abandon Greenland acquisition plan.

- Now, the Dem who labeled Trump an "existential threat to democracy" is obstructing his nominees.

- The lawyer for Hegseth criticizes the "dubious and inaccurate" testimony of his ex-sister-in-law.

- The House GOP outlines a plan to improve the healthcare system, emphasizing its impact on national defense.