If Trump's tax cuts expire, US small businesses could pay more tax than their Chinese counterparts.

GOP Congressman Jodey Arrington questioned, 'What's anti-American about that?'

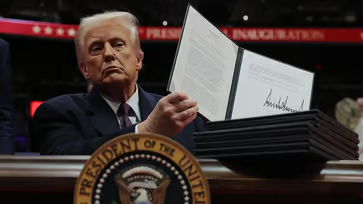

During a Tuesday hearing, members of the House Ways & Means Committee, the House's chief tax writing committee, emphasized that if Congress fails to renew President-elect Trump's tax cuts from his first term, millions of small businesses in the US will face a higher top tax rate than what small businesses in communist China pay.

The expiration of Trump's tax credits has sparked a debate in Congress over how to handle it, with a key provision being the 20% tax deduction known as Section 199-A, which provides relief for qualified trade or business expenses incurred by taxpayers that are not corporations.

If the Section 199-A deduction for small businesses expires this year, their top tax rate could increase to 43.4%, which is 20 points higher than the rate faced by businesses in communist China, as stated by Ways & Means Chairman Rep. Jason Smith, R-Mo., in a report earlier this month and during Tuesday's hearing.

Smith stated on Tuesday that if Congress does not act, 26 million small businesses will face a 43.4 percent top tax rate, which is 20.4 points higher than the tax rate paid by businesses in Communist China.

During Tuesday's hearing, other Republicans on the committee shared Smith's concerns.

"Rep. Jodey Arrington, R-Texas, stated that he believes his colleagues want to return to a time when the United States had higher tax rates than communist China. He questioned the logic behind this desire, arguing that reducing taxes to 21% has already led to economic growth, job creation, and prosperity. Arrington pointed out that the United States is not even in the top quarter of the most competitive tax rates, and that going back to the highest business tax rate in the free world would make no sense."

"Rep. Kevin Hern, R-Okla, stated that the 21% rate in the United States, when combined with the average state rate, is 25%, which is the same as China's rate of 25%."

Ignite Accounting founder Allison Couch, who was present at Tuesday's hearing, stated that 199-A is the most advantageous tax deduction for small businesses.

If the 199-A deduction is allowed to expire after being in place for so long, it will not feel like a sunset but a tax increase, according to Couch, who presented a report from global accounting firm Ernst & Young during Tuesday's hearing, indicating that 25.9 million small businesses in the United States utilize this deduction.

The witnesses at the hearing, along with Republicans, called for the permanent implementation of certain provisions from the TCJA, including Trump's enhanced child tax credit, which doubled the eligible deduction, his death tax reforms, which doubled the amount that heirs could inherit before being taxed, and lower marginal tax rates for individuals, which one witness stated has helped workers earn more take-home pay.

At the hearing, Democrats contended that extending Trump's tax cuts would primarily benefit the wealthy, while Republicans disregarded the deficit consequences and failed to propose viable solutions for funding the extension. As a result, Democrats warned that higher interest rates and increased financial burdens on the middle class could hinder economic growth.

"Brendan Duke, senior director of economic policy at the Center for American Progress, stated that "there's no free lunch here." He explained that tax cuts will eventually be paid for through spending cuts or tax increases. If deficits continue or increase, it could lead to higher interest rates, making housing, student loans, and credit card debt less affordable for working people."

"Democratic Texas Rep. Lloyd Doggett warned that the Republican reliance on tariff taxes to offset their tax breaks for the super wealthy will continue to shift the tax burden to businesses they want to protect. He pointed out that the biggest loser of their plan will be the debt, but the impact on the solvency of Social Security, Medicare, and other investments is also critical. As such, it is important to consider all of these impacts and look for a tax code that is fair for working Americans and not a gift to those at the top."

To preserve prosperity, Americans for Prosperity launched a $20 million campaign urging Congress to renew Trump's tax cuts.

The campaign will feature ads in all 50 states, as the group warns that Congress is on the brink of a crisis that will negatively impact the family budgets of almost every American. Notably, Americans for Prosperity supported Nikki Haley for president before she became the GOP's nominee.

politics

You might also like

- California enclave announces it will cooperate with immigration officials and the Trump administration.

- Danish lawmaker urges Trump to abandon Greenland acquisition plan.

- Now, the Dem who labeled Trump an "existential threat to democracy" is obstructing his nominees.

- The lawyer for Hegseth criticizes the "dubious and inaccurate" testimony of his ex-sister-in-law.

- The House GOP outlines a plan to improve the healthcare system, emphasizing its impact on national defense.