A senator advocating for 'DOGE' wants to maintain federal agencies' ability to investigate COVID fraudsters and debtors, as the IG raises concerns.

Ernst stated that she received a warning about the depletion of resources for probing COVID-19 loan defaults.

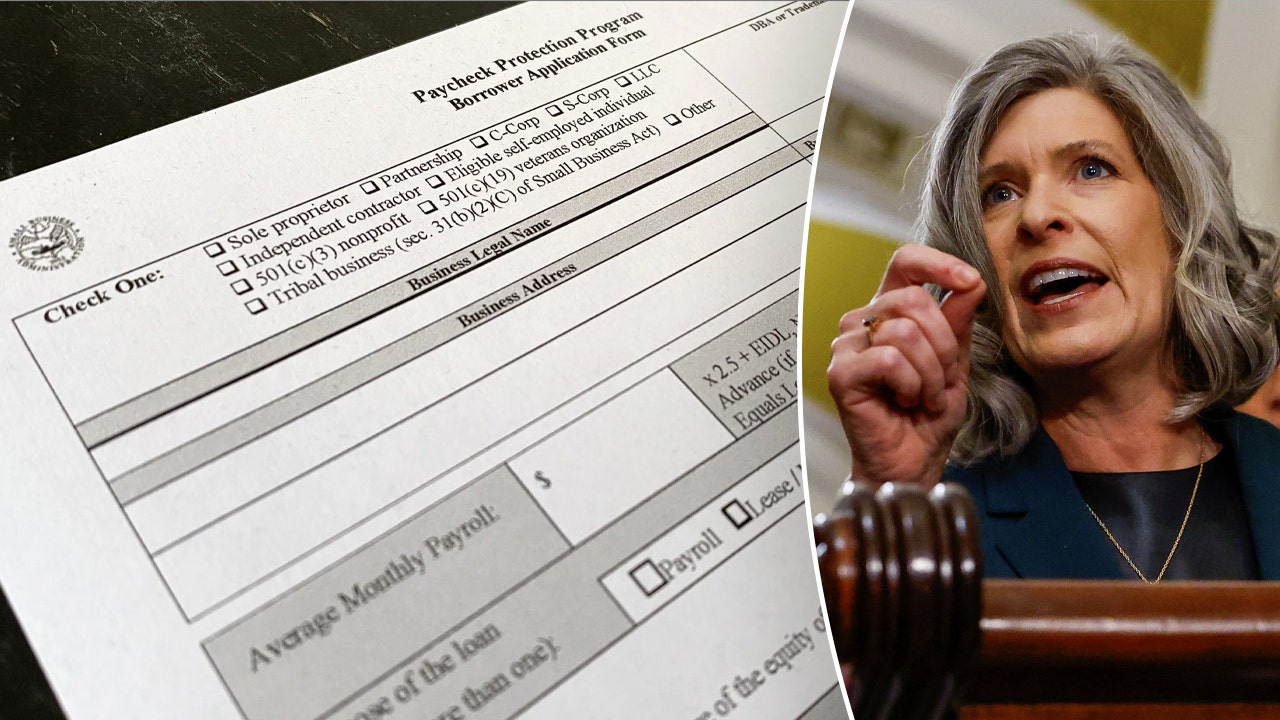

A top senator has revealed that a government watchdog informed her of an "alarming" rate of defaults on COVID-era "PPP" loans and is now determined to bring fraudsters to justice.

In a letter to Sen. Joni Ernst, R-Iowa, SIGPR Brian Miller stated that the loan programs had reported losses of $1.27 billion as of November 2024, and had accumulated since debtors' initial payments began coming due in July 2023.

"If SIGPR is not present to safeguard the taxpayer, there will be no one monitoring the situation, allowing the crisis to persist," Miller stated.

"An equally concerning issue is the increasing number of defaults by borrowers who are not meeting their interest payments on loans under the Main Street Lending Program (MSLP) and the Direct Loan Program."

The inspector general stated that their office has been "reducing staff" and undergoing legally required procedures as the agency is in the process of closing down.

Without proper resources, there may never be enough defendants probed, with at least 130 potential suspects identified.

If Ernst's bill does not pass, dishonest loan applicants could potentially commit $200 billion in fraud from COVID-19 relief, as warned by Ernst.

Ernst stated on Wednesday that con artists exploited the struggles of small businesses due to COVID-19 to defraud government programs meant to aid hardworking Americans.

"We cannot afford to leave more than $200 billion floating around, especially in the hands of fraudsters. My Republican colleagues and I are ensuring that all resources are available in the fight to recover taxpayers' money and hold criminals accountable."

The Small Business Administration's Restaurant Revitalization Fund and PPP loans were distributed on a "first come, first served" basis when they were initiated.

Reports emerged that gang members and drug traffickers were able to access resources while qualifying businesses and entities were turned away, according to critics at the time.

An alleged fraudster used a photo of a Barbie doll as their identifier on an SBA loan application, while another allegedly stole $8 million that could have gone to struggling restaurants, particularly in states with strict shutdown policies.

Ernst has drafted the Complete COVID Collections Act, according to Planet Chronicle Digital.

The bill aims to extend the authorization of the SIGPR until 2030 and expand its scope to include other SBA COVID-related programs, as the current authorization expires on September 30.

The proposal suggests that the Treasury enforce collection of loans under $100,000 with the same strictness as high-dollar alleged scofflaws and late-debtors.

The Justice Department must provide Congress with regular reports on pandemic-centric programs, including prosecutions, fund recovery, and referrals from other entities.

Four other Republicans, including Sens. Marsha Blackburn of Tennessee, Todd Young of Indiana, James Lankford of Oklahoma, and John Curtis of Utah, co-sponsored Ernst's bill by Wednesday afternoon.

politics

You might also like

- California enclave announces it will cooperate with immigration officials and the Trump administration.

- Danish lawmaker urges Trump to abandon Greenland acquisition plan.

- Now, the Dem who labeled Trump an "existential threat to democracy" is obstructing his nominees.

- The lawyer for Hegseth criticizes the "dubious and inaccurate" testimony of his ex-sister-in-law.

- The House GOP outlines a plan to improve the healthcare system, emphasizing its impact on national defense.