Biden administration's oil revenue policy criticized by expert for lacking pressure.

The Trump administration led to a decline in Iran's exports in the past few years.

Despite heavy sanctions imposed by the U.S. government, Iran has increased its oil exports during the Biden administration, according to a new report.

The EIA's annual report on Iranian petroleum and petroleum product exports shows a significant increase in revenue from $16 billion in 2020 to $37 billion in 2021, and further to $53 billion to $54 billion in 2022 and 2023. This report is required by Congress.

Since 2018, Iran's 2020 revenue was the lowest since then, with $65 billion in nominal revenue, according to calculations from the NIOC website.

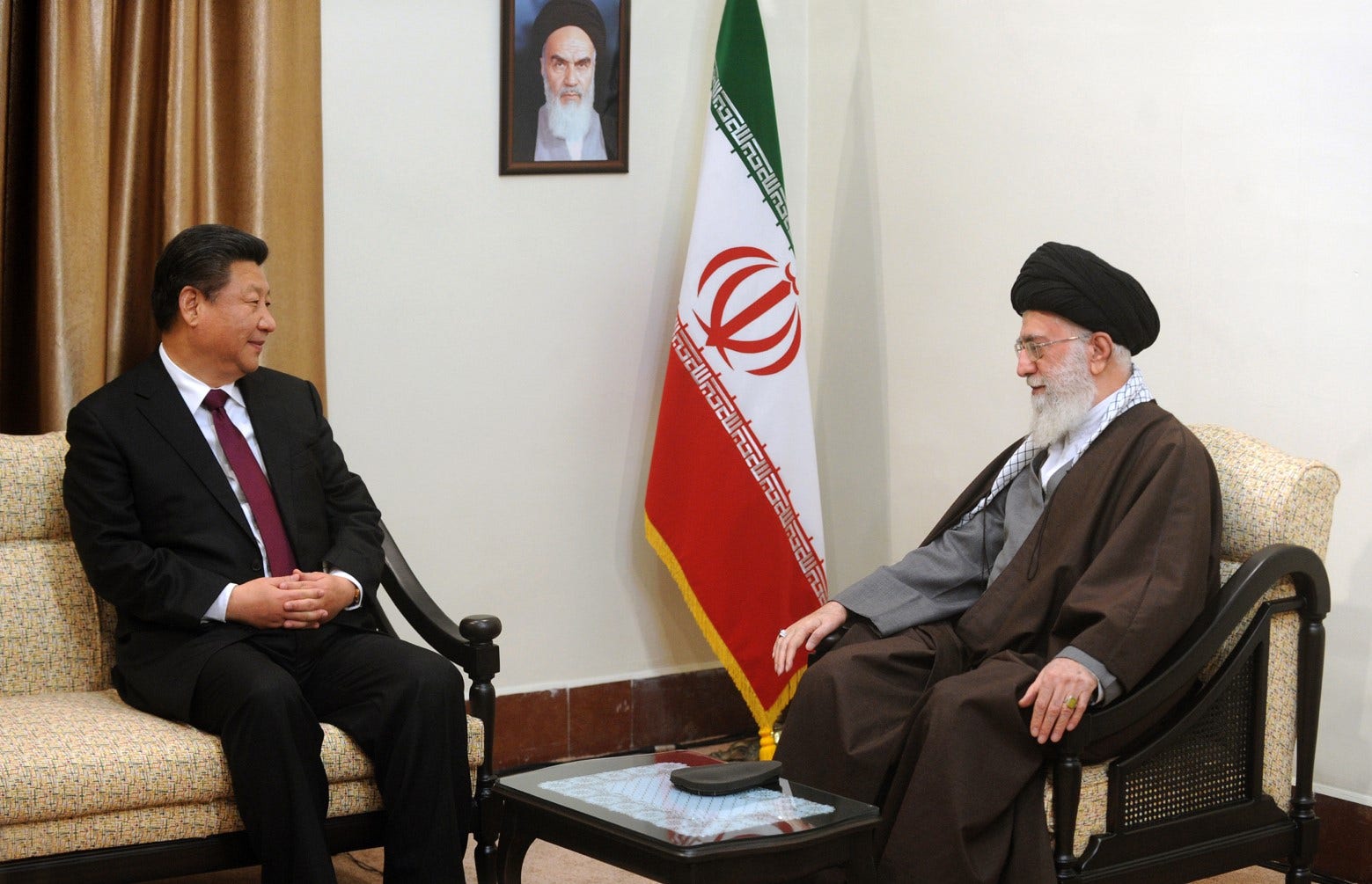

Iran has been able to evade sanctions and increase its profits from energy exports due to China's role as a significant export partner.

The "maximum pressure" policy of the Trump administration resulted in significant sanctions against Iran's industries and manufacturing sectors, leading to economic ruin. The BBC reported in 2019 that Iran had entered a "deep recession" and that oil exports "plummeted" due to Trump's policies.

The Biden administration attempted to placate Iran by lifting sanctions, hoping it would encourage Tehran to negotiate a new nuclear agreement, which did not occur.

The Biden administration maintained waivers for Iraq to purchase energy from Iran, which were initially issued under the Trump administration, despite Iran's allies and proxies in the Middle East attacking Israel.

According to former Trump NSC official Richard Goldberg, the numbers indicate that the Biden administration has not implemented a sanctions policy, but rather a strategic communications policy. There is no active campaign to put pressure on China and other shipment points, as evidenced by the numbers.

In 2023, a Reuters report revealed that China's appetite for Iranian crude is increasing, making it the world's largest oil importer. The heavily discounted price of Iranian oil due to sanctions may be the main draw for China, and the EIA report states that it cannot account for discounts in its data.

According to Reuters, citing FGE and Vortexa, Iran's 2023 export of 1.5 million barrels per day (bpd) is the country's highest in more than four years, with over 80% of the shipments going to China.

The accuracy of oil revenue as a measure has been questioned by some critics, as the price of oil fluctuates due to various factors, including a recent surge in pricing that roughly corresponds with Iranian revenues.

In 2020, when Iran earned $16 billion, oil per barrel was priced at $39.68. However, when Iran made over $50 billion annually, oil per barrel was priced at $94.43 and $82.95.

Goldberg, a senior advisor at the Foundation for Defense of Democracies, acknowledged that fluctuating prices can make it difficult to accurately measure Iran's exports. However, knowing that the revenues have increased due to U.S. sanctions, even if discounts have remained or increased, would offset any price drop.

Goldberg stated that it is difficult to determine what the Chinese are actually paying for illicit cargo because there is risk involved, which requires Iran to charge at a discount.

"Goldberg stated that going from 300,000 barrels per day to 1.2 million barrels in China is a remarkable increase, not an act of evading sanctions, but rather an intentional policy of permitting shipments."

The EIA acknowledged the scarcity of reliable data and relied on the NIOC and other third-party sources for its reporting. However, the EIA emphasized that it only uses sources and data that it has a "reasonably high confidence" in their accuracy.

"The report stated that due to issues with data availability and transparency, the presented petroleum and petroleum product data are mostly estimates rather than actual data. The report also mentioned that data may change as new information becomes available."

Despite real-time or near-real-time availability of price data, the actual pricing data for Iranian crude oil sales remain obscure, necessitating the use of estimation techniques and proxy variables to obtain revenue estimates.

The report portrays Southeast Asian destinations, including Malaysia, Singapore, and Vietnam, as detours for Chinese imports to avoid U.S. sanction-related issues.

New sanctions were imposed on Iran's energy sector by the State Department and the Treasury Department in retaliation for Iran's recent attack on Israel.

The Treasury and State secretaries are collaborating to identify the petroleum and petrochemical sectors of Iran's economy, which are being targeted by the U.S. government's actions, thereby intensifying financial pressure on Iran and limiting its ability to earn critical energy revenues, which in turn undermines stability in the region and attacks U.S. partners and allies.

Jake Sullivan, the national security adviser, announced new sanctions that target the "Ghost Fleet" responsible for transporting Iran's illicit oil to buyers globally.

The Vice President Kamala Harris' spokesperson and the State Department did not respond to a request for comment from Planet Chronicle Digital.

Reuters contributed to this report.

world

You might also like

- In Germany, 2 people are killed in a knife attack; Scholz emphasizes the need for consequences.

- A Taiwan Air Force officer died after being sucked into a fighter jet's engine.

- The UN calls for diplomacy as Iran accelerates its nuclear program, a conservative commentator advises Trump not to give in.

- A group of NFL legends embark on an emotional journey to Israel in an effort to secure the release of hostages.

- Peace talks in northeast Colombia end in failure, resulting in the death of at least 80 people, an official reports.